rant: saving grace

Phoebe Thorburn is avoiding buyer’s remorse at all costs.

We’ve teamed up with the folks at UNiDays to bring you stories about all the stuff you go through when you're studying. Did you know UNiDAYS members can nab a 15 per cent discount on their frankie magazine subscriptions? Well, now you do. Check the bottom of the story for more deets.

We’ve teamed up with the folks at UNiDays to bring you stories about all the stuff you go through when you're studying. Did you know UNiDAYS members can nab a 15 per cent discount on their frankie magazine subscriptions? Well, now you do. Check the bottom of the story for more deets.

Ever since my mum explained the term post-purchase dissonance (PPD) to me while dress shopping at Southland as a teen, I’ve been on a mission to avoid spending my precious dosh on anything I’ll regret.

PPD is the anxiety, doubt or regret that shows up after buying something that – for whatever reason – wasn’t the right decision. It could be that you didn’t actually need the thing, you should have done more research, you felt pressured by the shop assistant, or you spent outside of your budget.

While I personally don’t have a big mortgage to pay or family to support, just being a 20-something freelancer in a cost-of-living crisis has made any monetary missteps feel more consequential than ever. As a result, I’ve become practically addicted to maintaining a streak of aligned, considered purchases that don’t leave a creeping sour feeling in my gut.

A welcome purchase is one I’ve sat on for a while; it makes my life easier in some way and helps me be the person I want to become. A reckless purchase, on the other hand, soon gives off ‘to-do list’ energy. Think a puzzle collecting dust on the shelf, never to be assembled, or a pair of shoes that stare at you from the bottom of your wardrobe, asking to be worn.

Maybe it’s getting older, knowing myself better, or my love for pattern recognition, but over time I have gotten better at stopping those reckless purchases in their tracks. I’ve gained more self-control at secondhand shops and halt attachment to clothing items when the fit or quality isn’t right. I’ve taken notes from the sizeable unworn portion of my wardrobe to understand which fabrics and styles I actually reach for. I’ve started to ask myself revealing questions about what I want to buy and then (crucially) honour the truthful answer.

Figuring out what I feel OK spending my money on spontaneously versus consciously has also helped me dodge the post-purchase regret. Good food, educational material and anything that helps make memories with friends are things I’m happy to spend my money on more freely, while I give clothing, décor and new tech purchases a lot more deliberation.

I am grateful to my developing adolescent brain for internalising PPD’s premise and the positive ways it’s shaped my spending habits since. However, clinging to it in the current climate has revealed its limits as a rigid and unnuanced explanation for all spending experiences in adult life. A more sustainable relationship to my bank account would allow for purchases across the spending spectrum, like silly treats, extensively researched decisions, mundane adult needs, in-the-moment buys and the occasional fluff-up. Because if I’m purchasing in line with my values, priorities and intentions 90 per cent of the time, I think that’s good enough!

Much worthwhile spending sits in a grey area, anyway, like supporting a friend’s small business, investing in your mental health or donating money to a cause you believe in. All these things feel worthwhile and important, yet they often also come with a side serve of complicated feelings. Maturing is realising that not everything is black and white, and it’s honestly a relief to free my spending habits from that lens as well.

Currently, I’m not earning very much while I wrap up an enormous creative project that I’ve been working on in my spare time for the last few years. Instead of sweating that less money is coming in, I’m trying to remind myself that this is an aligned financial choice I made, and I am allowed to enjoy this chapter of immensely gratifying work.

There’s a lot of noise from the outside world about our money habits, so I can sometimes default to a more rigid saving mindset and forget to relish the financial position I’ve worked so hard to be in. Going forward, I want to keep confidently to my own lane and continue to work on accepting my preferences and tastes so that any spending frameworks or decisions I make set me up for success. I want to sift through the external noise with a critical ear and know what works for me.

Thanks to the kind types at UNiDAYS, uni students can nab 15 per cent off their frankie subscriptions. Just click here, then register or log in using your UNiDAYS member details. Easy as!

Thanks to the kind types at UNiDAYS, uni students can nab 15 per cent off their frankie subscriptions. Just click here, then register or log in using your UNiDAYS member details. Easy as!

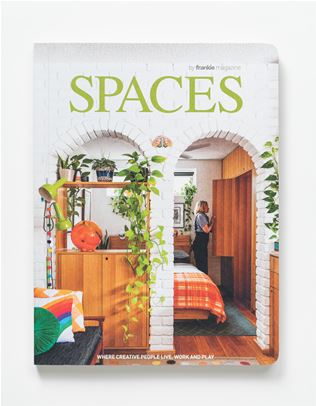

This rant comes straight from the pages of issue 127. To get your mitts on a copy, swing past the frankie shop, subscribe or visit one of our lovely stockists.

.jpg&q=80&w=316&c=1&s=1)

.jpg&q=80&w=316&c=1&s=1)